WHAT IS BLOCKCHAIN?

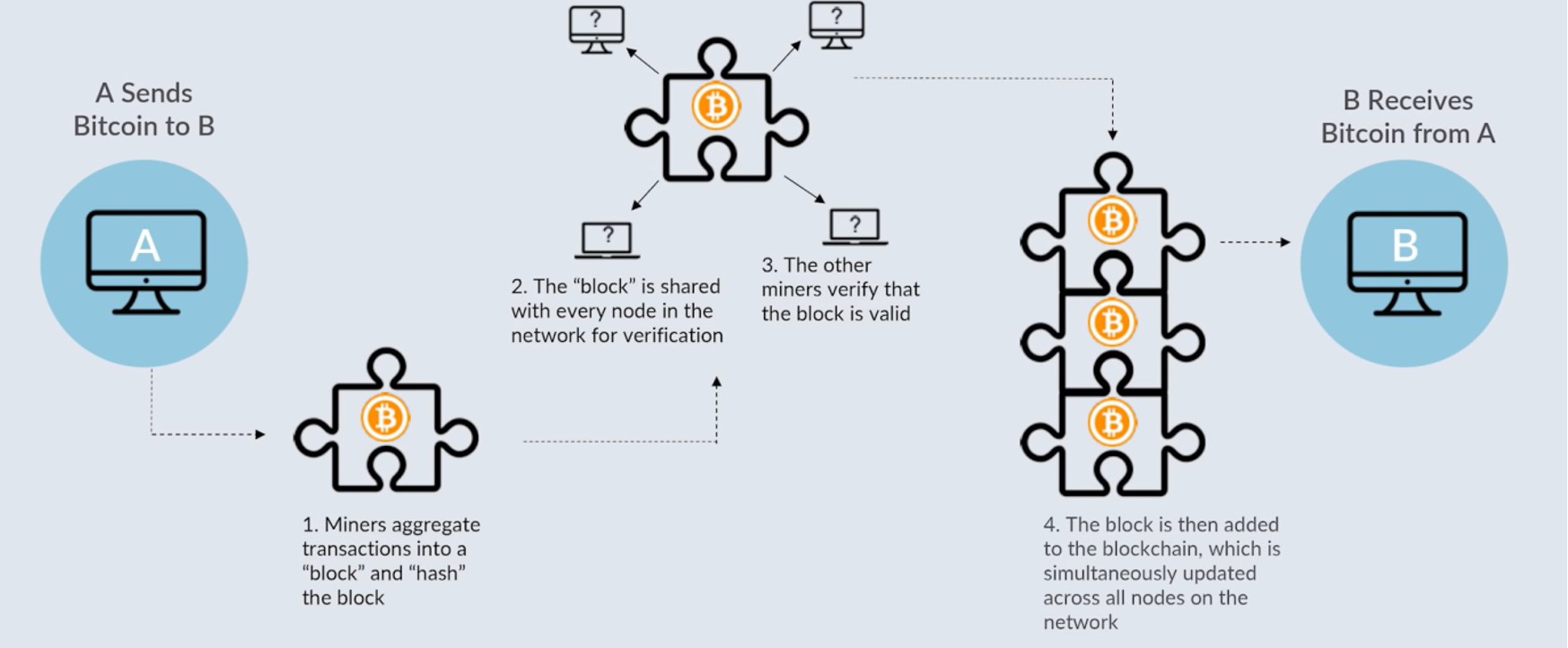

- Distributed ledger that records a trail of transactions.

- Updates simultaneously across all points in a network as soon as it is altered.

- Arose with the arrival of Bit coin in 2008.

- The record it keeps is permanent and irreversible

- A closed block chain.

- A network of nodes operated by a handful of trusted banks.

- Makes banks the intermediaries rather than miners.

- Permissioned block chains are a hybrid of public and private block chains where anyone can access them as long as they have permission from the administrators to do so.

ADVANTAGES OF PERMISSIONED BLOCKCHAIN?

- Increased Speed of Clearing Transfers

- Interbank transactions are significantly faster.

- Secure Data

- Data in a block cannot be changed later without changing the hash value assigned to its block.

- Hence, any data tampering can be flagged and traced quickly.

- KYC Efficiencies

- All the information on a customer compiled at one bank can be shared across all the other banks on the network.

ANTI - MONEY LAUNDERING WITH PERMISSIONED BLOCKCHAIN

- Unwind Shell Company Transactions.

- Money laundering happens through shell companies.

- With blockchains, you have an unbroken trail of the transactions which can be traced back to its source.

- Suspicious Activity Reporting Efficiencies

- Regulators can also be given a node on a permissioned blockchain.

- They can be given access to all necessary data.

Blockchain has two main applications:

- One familiar use of blockchain technology involves trading and managing crypto currencies like Bitcoin.

- The other main use of blockchain is for managing transactions related to trade and commerce, including finance processes like payables, receivables, and compliance.

We think of these as business blockchains. Business blockchains are being used today to help reinvent how transactions are managed. They can take time and costs out of almost any process, enabling near real-time operations. And they deliver a high degree of accuracy and control, with much less risk than many alternatives.

Business blockchain can automate VAT settlement and reporting. This is achieved by distributing validated invoices between relevant parties (e.g. buyer, seller and tax authorities) using blockchain

National governments are losing billions in VAT and responds with increasing compliance requirements. VAT is the key revenue driver for tax authorities and the largest contribution to governmental budgets. Therefore, the incentive to search for ways of more effective VAT collection is big.

On both international and national level, the VAT system is fraught with a variety of problems. It is highly reliant on businesses themselves to correctly settle the amount of VAT and submit it to tax authorities.

- In addition, VAT is settled over a fixed period, for example, monthly or quarterly where misalignment on which dates count (e.g. invoice date or posting date) increases complexity.

This makes controlling of VAT data troublesome as each company maintains their own ledgers and time their VAT settling differently.

- Blockchain provides some interesting features, which could help counter these complications, by providing one single source of truth and the possibility to distribute information between several parties in a secure way.

- We postulate that these features could enable a better automatic VAT reporting in real time. Hence, the future of TAX reporting could be less rigid, complicated and more resistant to fraud.

Leave a comment

All Blogs

To make an enquiry or book an appointment, just fill this contact form and submit it. We'll surely get back to you.